Key US WealthTech investment stats in Q1 2025:

US WealthTech funding increased by 9% QoQ in Q1Deals over $100m rose by 80% QoQ as investors prioritised high-value dealsCredCore, a New York-based vertical-AI company transforming debt capital markets for lenders and borrowers, secured one of the top US WealthTech deals of the quarter with a $16m funding round

US WealthTech funding increased by 9% QoQ in Q1

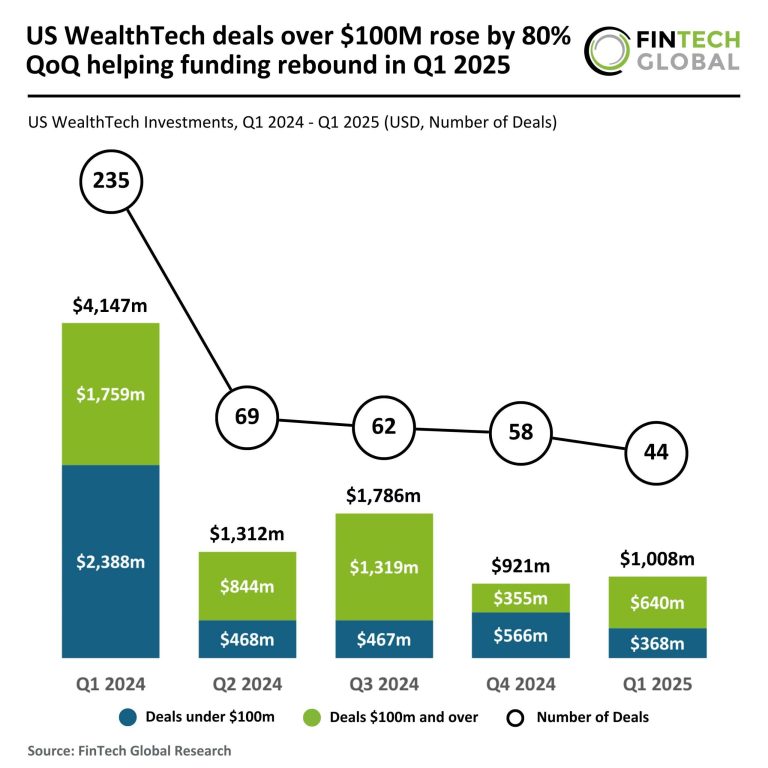

In the first quarter of 2025, the US WealthTech recorded 44 deals, representing a 24% decline from the 58 deals seen in Q4 2024 and a significant 81% drop from the 235 deals recorded in Q1 2024.

Total funding in Q1 2025 reached $1bn, up 9% from the $921m raised in Q4 2024 but down sharply by 76% from the $4.1bn secured in Q1 2024.

The average deal size in Q1 2025 stood at $23m, marking a rise from $16m in Q4 2024 and significantly higher than the $18m average seen in Q1 2024, suggesting a tilt towards fewer but larger deals as investors focus on established or late-stage players.

Deals over $100m rose by 80% QoQ as investors prioritised high-value deals

Funding from deals under $100m totalled $368m in Q1 2025, down 35% from the $566m raised in Q4 2024 and a steep 85% drop from the $2.4bn recorded in Q1 2024.

Larger deals worth $100m or more brought in $640m, an 80% decrease YoY from the $1.8bn raised in Q1 2024, but up 80% from the $355m recorded in Q4 2024.

This sharp recovery in high-value deals QoQ may signal renewed confidence in select WealthTech firms, even as overall deal activity remains subdued amid broader market caution.

CredCore, a New York-based vertical-AI company transforming debt capital markets for lenders and borrowers, secured one of the top US WealthTech deals of the quarter with a $16m funding round

The funding round was led by Avataar Ventures, alongside participation from Inspired Capital, Fitch Group, BellTower Partners, and senior figures in asset management.

Founded in 2022, CredCore leverages advanced AI models guided by credit experts to streamline the entire debt deal lifecycle—from pre-deal evaluation to post-deal management—enabling credit funds to scale assets under management more efficiently.

Its agentic platform significantly reduces the time required to analyse and extract insights from complex deal documentation, accelerating capital deployment.

The funding will support the expansion of its AI capabilities, team growth, and platform enhancement to serve a wider spectrum of credit market participants, cementing CredCore’s position at the forefront of WealthTech innovation in the evolving credit investment landscape.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.