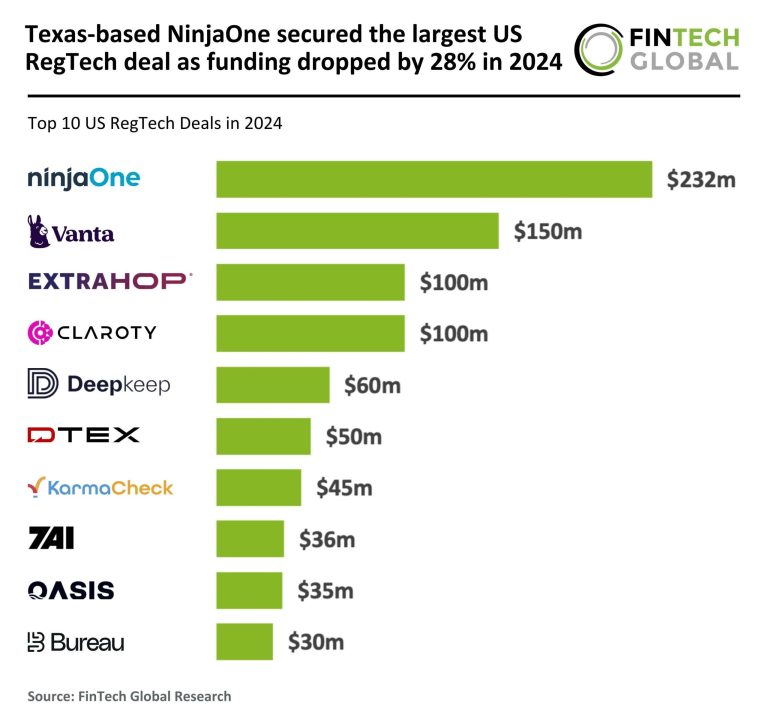

Key US RegTech investment stats in 2024:

US RegTech funding dropped by 28% YoY in 2024Californian companies dominated the US RegTech space with four of the top 10 deals during the yearNinjaOne, a Texas-based RegTech company specialising in endpoint management, security, and compliance automation, secured the biggest US RegTech deal of the year with its $231.5m Series C funding round

US RegTech funding dropped by 28% YoY in 2024

In 2024, the US RegTech sector secured $5bn in funding across 228 deals, marking a 28% decline from the $7bn raised in 2023 and a 45% drop in deal volume compared to the 413 transactions recorded the previous year.

Despite this decline, the sector remains significantly larger than in 2020, when it raised $4.4bn across 389 deals.

The average deal size in 2024 stood at $22m, an increase from $16.9m in 2023 and more than double the $11.3m recorded in 2020, reflecting a trend where investors are favouring more mature RegTech companies over smaller, early-stage startups.

This shift may be driven by increasing regulatory complexity, prompting investors to focus on established firms with proven solutions rather than riskier, early-stage ventures.

Californian companies dominated the US RegTech space with four of the top 10 deals during the year

California continued to dominate the sector, securing four of the top 10 deals in both 2023 and 2024, underscoring the state’s position as a hub for regulatory technology innovation.

Washington made notable gains, increasing its presence from one top deal in 2023 to two in 2024, while New York maintained a steady presence with two top deals.

Texas and Massachusetts also featured in the 2024 rankings, similar to their presence in 2023.

However, Colorado, Maryland, and an additional New York deal from 2023 dropped off the list, indicating a shift in investor focus away from these states.

The continued strength of California and New York aligns with broader FinTech trends, while Washington’s rise suggests growing interest in regulatory technology solutions emerging from the Pacific Northwest.

NinjaOne, a Texas-based RegTech company specialising in endpoint management, security, and compliance automation, secured the biggest US RegTech deal of the year with a $231.5m Series C funding round

The funding round was led by ICONIQ Growth.

This investment, which valued the company at $1.9 billion, accelerated NinjaOne’s innovation in regulatory compliance, risk mitigation, and IT governance, addressing the growing complexity of endpoint security in a hybrid work environment.

Originally founded to modernise remote monitoring and management for MSPs, NinjaOne has expanded its platform to serve over 17,000 customers across 80 countries, managing more than seven million endpoints.

Its solutions automate compliance workflows, enhance real-time risk visibility, and integrate with critical IT and security systems, ensuring businesses maintain regulatory standards efficiently.

With this funding, NinjaOne aims to scale its platform, expand its security capabilities, and reinforce its position as a leader in regulatory technology, helping organisations mitigate compliance risks while improving IT resilience.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.