Key US WealthTech investment stats in Q1 2025:

US WealthTech deal activity dropped by 71% YoY in Q1 2025New York firms dominated the US WealthTech market securing 29% of all deals in the quarterTaktile, a category-defining WealthTech platform specialising in automated risk decisioning, raised $54m in a Series B funding round, making it one of the largest US WealthTech deals of the quarter

US WealthTech deal activity dropped by 71% YoY in Q1 2025

In Q1 2025, the US WealthTech industry experienced a sharp contraction in both deal activity and funding.

A total of 68 deals were recorded, representing a steep 71% decline from the 235 deals completed in Q1 2024.

Funding followed a similar downward trajectory, plummeting 76% to $1bn, down from $4.1bn raised in the same period last year.

This significant drop in both volume and value of deals reflects continued investor caution and a broader slowdown across the FinTech investment landscape, particularly in the WealthTech vertical.

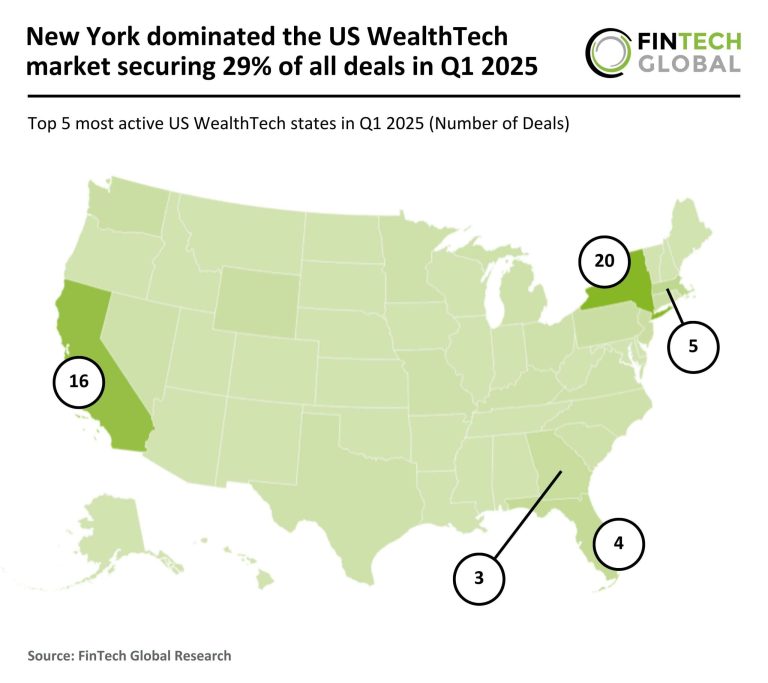

New York firms dominated the US WealthTech market securing 29% of all deals in the quarter

New York emerged as the most active WealthTech market in Q1 2025, with 20 deals (29% share), although this marks a 57% drop from the 47 deals it completed in Q1 2024.

California followed closely with 16 deals (24% share), down significantly from 96 deals (29% share) in the previous year.

Massachusetts completed five deals (7% share), entering the top three and replacing Texas, which had previously recorded 26 deals (8% share) in Q1 2024.

While overall deal numbers have fallen sharply across the board, New York and California continued to play a central role in US WealthTech activity, highlighting their enduring significance even amid turbulent market conditions.

Taktile, a category-defining WealthTech platform specialising in automated risk decisioning, raised $54m in a Series B funding round, making it one of the largest US WealthTech deals of the quarter

Backed by Balderton Capital and a consortium of prominent investors including Index Ventures and Tiger Global, this brings the company’s total funding to $79m.

Taktile enables financial institutions, including banks, insurers, and FinTechs, to build and optimise AI-powered risk strategies across credit underwriting, fraud detection, and compliance workflows.

Its platform is already delivering hundreds of millions of high-stakes decisions each month, empowering teams to adapt faster to shifting risk environments while maintaining precision and transparency.

In 2024, Taktile achieved over 3.5x growth in annual recurring revenue, quadrupled its customer base across 24 markets, and received multiple accolades recognising its leadership in decision intelligence.

With its tools being leveraged by institutions such as Allianz and Rakuten Bank, the company is at the forefront of transforming how risk is managed at scale, helping organisations modernise financial decisioning in a regulatory landscape that increasingly demands control, agility, and accountability.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.