The Fanjul family has been wooing politicians for decades, but their bet on the Trump administration is their best yet, after the president added tariffs for foreign competitors and pushed Coca-Cola to use its cane sugar to make American soda great again.

To celebrate Donald Trump’s second inauguration earlier this year, Coca-Cola CEO James Quincey came to Washington with an appropriate symbol of appreciation: a commemorative edition of the president’s favorite beverage, Diet Coke. But the meeting got a little tense when Trump asked why the company doesn’t use cane sugar in its signature soda—commonly referred to as “Mexican Coke”—and Quincey demurred, saying that “there wasn’t enough supply.”

Trump wasn’t buying it, according to the book 2024: How Trump Retook The White House, and soon called up one of his top political donors and friend of more than 40 years, José ‘Pepe’ Fanjul—the 81-year-old Palm Beach sugar magnate who lives near Mar-a-Lago—to ask if the information was true. That conversation appears to have planted the seed for what transpired in the months following the inauguration, which Fanjul attended after donating nearly $1 million. Over the summer, when Quincey returned to Washington, Trump brought up the cane sugar issue again, and then shortly after he announced on social media that Coca-Cola would create an entirely new line: “This will be a very good move by them—You’ll see. It’s just better!”

Fanjul and his siblings—who control a sugar and real estate empire, including Domino Sugar and Florida Crystals, that Forbes estimates to be worth some $4 billion—have been jockeying for the Coca-Cola business ever since. Even as the highly anticipated U.S. cane sugar line is expected to begin production soon, as Coca-Cola confirmed it would launch this fall, details of where the Atlanta-based beverage giant will source its U.S-farmed cane sugar remain scant. Coca-Cola declined to comment. Yet a source familiar with the company’s launch told Forbes that Coca-Cola “is trying to keep this under wraps” but confirmed that the Fanjuls “will be in the mix.”

Although it will probably not be an exclusive contract, the Fanjuls are among the best-positioned to take advantage of Coca-Cola’s American cane sugar expansion.

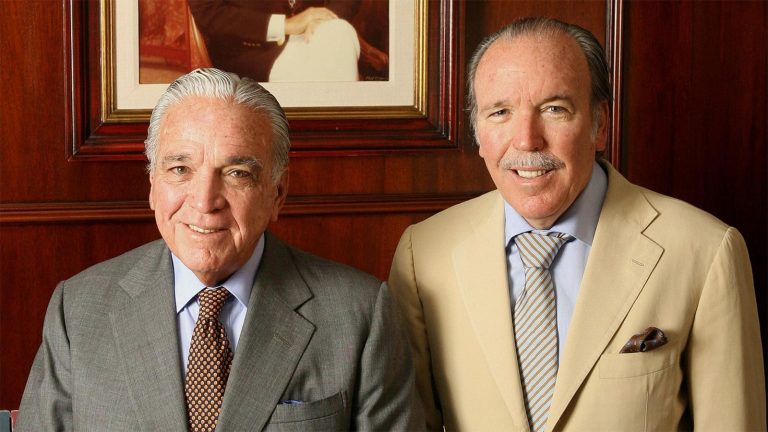

The Fanjul siblings—vice chairman and president Pepe, 81, and CEO and chairman Alfonso, 88, known as Alfy, as well as Alexander, 75, Andres, 67, and Lillian, 87, who serve as senior vice presidents and directors in the family business—are the owners of the largest cane sugar refiner in the world. The family makes 16% of raw sugar produced in the U.S. through Florida Crystals, which recorded $5.5 billion in revenue in 2024. In addition to their sugar mills, refineries, and real estate, the Fanjuls’ empire also includes the famed Casa de Campo resort in the Dominican Republic.

The Sweet Life: The Fanjul Group owns a stake in Central Romana in the Dominican Republic, the country’s largest private employer and landowner, including the Casa de Campo resort.

Casa de Campo Resort & Villas

The Fanjul family, who emigrated to South Florida from Cuba in 1959, following the Fidel Castro-led revolution in their home country, have long donated to both political parties. They also have plenty of critics. The Cato Institute’s Colin Grabow, who published a 2018 report titled “Candy-Coated Cartel: It’s Time To Kill The U.S. Sugar Program,” says that if the Fanjuls represent the American Dream, that’s “a pretty cynical take on what the American Dream is.”

“It’s not the classic American story of you get in and you develop cozy connections with politicians and you try to bend government policy to your will,” says Grabow. “The American Dream is you succeed based on your inventiveness and your hard work and not because of your ability to manipulate government policy.”

A representative for the Fanjuls responds: “The Fanjul family is grateful for the opportunities that are possible in this country through determination and a strong work ethic. Their story is the American Dream.”

The family has been a supplier to Coke for many years, though never exclusively, and never for any specific product. For Coca-Cola, working exclusively with Florida Crystals—which is the largest certified regenerative organic farm in the U.S. and the only one growing sugar—would present the chance to promote a sustainable and traceable supply chain.

The Fanjuls’ embrace of sustainability is a recent development. The clan is better known for weathering decades of accusations that its farms pollute waterways from chemical runoff (the Fanjuls’ representative says their “farms filter the water and release it cleaner than when it arrived.”) There’s also alleged air pollution from burning sugarcane leaves to prepare plants for harvest, which can release toxic gasses into the air. (They say it’s a “common method” that’s “highly regulated” by the state and that they do not burn within two miles of any residential or commercial structure.)

The firm operates a renewable energy plant powered by sugarcane fiber and one of the country’s 10 largest compost facilities, too. “We are members of those communities. Our employees live in them, and we are committed to protecting and serving them,” says the representative.

Environmental degradation is not the only sin that the Fanjuls have been accused of. There have been allegations of forced labor in the Dominican Republic, which they have denied for years. (The company says it’s “proactive regarding improving the labor conditions.”)

“The [Fanjuls] did not achieve success overnight,” adds the representative. “Over the past 65 years, through hard work, determination, and expertise, they grew their business to where it stands today.”

The Fanjul family began farming and producing sugar in Cuba in the 1850s, eventually becoming one of the largest producers in the country. The siblings’ parents, Alfonso Fanjul Sr. and Lillian Gomez-Mena, married in 1936, uniting two of the island’s wealthiest sugar families. By 1959, their sugar empire had ten mills, real estate across Cuba and a broker in New York. But after the revolution, Castro seized their assets.

“I was sitting in the family office when Fidel Castro’s people came in to discuss what was going to happen. We sat down with lawyers, and I had a yellow pad and pencil, and they put machine guns on the table,” Alfy recalled in a 2013 speech at Fordham University, his alma mater that he graduated from just as the revolution ended in 1959. “We chatted for a while, and then the leader grabbed the machine gun, pointed to the map on the wall where we had the different properties our company owned, looked at me, and said, ‘We’re going to take it all away.’”

After fleeing to New York and pooling $640,000 (more than $7 million in today’s dollars) with other well-off Cuban refugees, the Fanjuls bought 4,000 acres of land in Pahokee, on the shores of Florida’s Lake Okeechobee. They then purchased old parts of smaller sugar mills in Louisiana and shipped them in by barge. Their first American sugar mill opened in 1960.

Alfonso Jr., who was then just 22, went to work for his father in the family business, and eventually Pepe, Andres and Alexander joined as well. The brothers got their first big break in 1984, when they bought the sugar operations of Gulf and Western, a conglomerate that at the time owned Paramount Pictures. To pay for it, the Fanjuls took out $240 million in debt (or about $750 million in current terms). As Pepe later told Vanity Fair, “That put us on the map.”

Ever since, the Fanjuls learned to make themselves well-heard. Take Alfy’s relationship with the Clinton administration, after serving as co-chairman of his Florida campaign in 1992.

On Presidents’ Day in 1996, Bill Clinton was interrupted while breaking up with Monica Lewinsky in the Oval Office when the phone rang. The president took the call from Alfy, who then spent 20 minutes complaining to him about Vice President Al Gore’s proposal to tax Florida sugar growers a penny per pound to fund the cleanup of the polluted Florida Everglades. Whatever Alfy said worked: According to reporting at the time, Clinton quietly withdrew his support.

Says Cato’s Grabow, “The ability to call up the president of the United States and get him on the phone for an extended period of time says something about the kind of pull that these guys enjoy.”

By the late 1990s, the Fanjuls’ sugar business had $275 million in sales and the family owned more acreage than U.S. Sugar, its biggest rival. Alfy and Pepe went on a buying spree, picking up a New York sugar refinery in 1998 and acquiring Domino Sugar for $200 million in 2001. That same year they rolled up those refineries into ASR Group and later added other brands including C&H. By 2007, Florida Crystals’ revenues had grown to $3 billion.

ASR is now the world’s largest cane sugar refiner, and it’s entirely owned by Florida Crystals. For 26 years, the Sugarcane Growers Cooperative of Florida owned a minority stake, but the Fanjuls bought the co-op out in 2024 for an undisclosed amount.

Apart from Florida Crystals, the Fanjuls’ most high-profile business is the Dominican Republic’s agricultural and tourism conglomerate Central Romana. They own 35%, worth about $190 million, according to corporate records in Luxembourg. Central Romana is also the Dominican Republic’s largest sugar producer, which the Biden Administration banned from importing into the U.S. in 2022 amid allegations of forced labor on some of its sugar farms. At the time, the government’s investigation of Central Romana included accusations of 11 different indicators of forced labor, including abuse of vulnerability, isolation, withholding of wages, abusive working and living conditions and excessive overtime.

A representative for Central Romana said that the company has “always disputed” the government’s allegations. They added that the company has invested more than $50 million in free living facilities for its agricultural workers, as well as schools and sanitary infrastructure, and that it pays salaries that are 50% higher than the legal minimum wage in the Dominican Republic.

Restrictions on the company were removed in March—making Central Romana one of the few foreign winners of Trump’s first year in office. According to a U.S. Customs and Border Protection spokesperson, the order was “modified” following “documented improvements to labor standards, verified by independent sources.”

“Central Romana has taken action to address the concerns outlined,” the spokesperson told Forbes. “CBP will continue to closely monitor compliance.”

Pepe remains a prominent figure in Trump’s inner circle. He attended and hosted fundraisers for him during the 2016 and 2020 presidential campaigns, and in May 2024—on the day of Trump’s conviction in New York on 34 counts of falsifying business records—he cohosted a fundraiser for Trump at his luxury co-op on Manhattan’s Upper East Side.

The First Soda: Earlier this year, Donald Trump lobbied Coca-Cola to use American sugarcane, which would be a boon to the Fanjuls, who have long been Trump donors and live near Mar-a-Lago.

Lynne Sladky/AP

In all, the Fanjul family and their companies have given more than $7 million to Trump fundraising committees and super PACs since 2016. Since 1977, they’ve spent at least $24 million on federal and Florida state campaigns and PACs, giving both to Democrats and Republicans, according to data from the Federal Election Commission and Florida’s Department of State. Florida Crystals has also spent more than $20 million lobbying federal politicians since 1999.

Cane sugar prices in America have been boosted by the government for decades through market price supports as well as below-market loans. The price of sugar in the U.S. is roughly twice as much as the global sugar market, per the Federal Reserve Bank of St. Louis. And that government support isn’t ending anytime soon: Those loans were also a part of the Trump Administration’s Big Beautiful Bill, signed into law on July 4, which increases the loan rate for raw cane sugar from 19.75 cents per pound to 24 cents. Trump also slapped a 50% tariff on Brazil, the biggest exporter of raw sugar to the U.S. (The Fanjuls also source sugar from Brazil.)

The help is much-needed. Global sugar prices have been volatile over the past decade, and companies like Florida Crystals and its competitors have struggled due to lower prices and a negative outlook for commodities. That’s why expanding their business with Coca-Cola will be a nice sweetener for the Fanjuls. And if Trump can keep American sugar prices high and competitors out, they’ll keep profiting. When he eventually leaves office, they can always go back to doing what they know best—courting politicians on both sides of the aisle.

More from Forbes