From selling coffee to labeling data for AI models, see how the latest additions to Forbes’ annual list got so rich.

There are some things only money can buy, including a spot on The Forbes 400 ranking of America’s richest people. The price, however, has never been higher. It takes a record-breaking $3.8 billion to make the club in 2025, up $500 million from a year ago amid soaring markets. More than 90% of the list made last year’s ranking, too. But 14 lucky billionaires managed to muscle their way into this elite group for the first time this year.

They made their fortunes in everything from coffee shops to cancer diagnostics and, of course, the AI boom. In all, these 14 Forbes 400 newcomers are worth $113.3 billion, or $8.1 billion on average. Four of them are worth more than $10 billion.

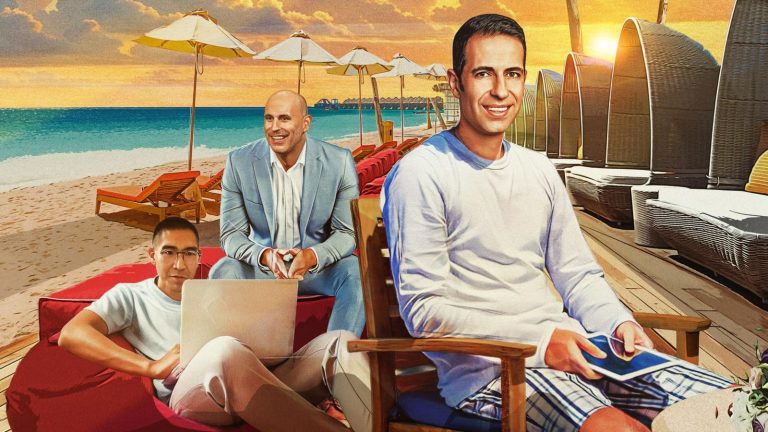

The richest newbie is Edwin Chen, who Forbes estimates is worth $18 billion, thanks to an estimated 75% stake in data labeling company Surge AI, which he founded and runs as CEO. The second richest is Adam Foroughi (estimated fortune: $17.4 billion), the cofounder and CEO of marketing software and mobile game maker AppLovin, which placed three newcomers on this year’s list, including the “poorest” newcomer, early investor Eduardo Vivas ($3.8 billion). The cofounders of liquified natural gas exporter Venture Global, Robert Pender and Michael Sabel ($12.8 billion each), are tied as the third-wealthiest Forbes 400 first-timers.

Another 22 billionaires returned to the ranking after dropping off the list in a previous year, including crypto kingpins Cameron and Tyler Winklevoss and stock trading app Robinhood’s Baiju Bhatt. Bhatt’s cofounder Vlad Tenev made The Forbes 400 for the first time in 2025.

Tenev is one of the eight first-timers who got rich in technology. The other six newcomers hail from a wide range of industries, including energy and finance & investments (2 each), as well as food & beverage, and healthcare (1 each). Their average age is 50, compared to 70 for the list overall, meaning these 14 new members of The Forbes 400 might have a spot on the ranking for years to come.

Here are the 14 new members of The Forbes 400 in 2025.

Net worths are as of September 1, 2025

Eduardo Vivas

Net worth: $3.8 billion | Age: 39 | Source of wealth: Marketing software, mobile games

Vivas is one of eight billionaires from marketing software and mobile game maker AppLovin, which has seen its market cap soar more than sixfold, to over $160 billion, since its 2021 IPO. Two of those billionaires are not American and another three were too poor to make this year’s Forbes 400 cutoff. That leaves Vivas, who cofounded an earlier startup with AppLovin’s CEO Adam Foroughi and invested early in his buddy’s latest venture, as one of three billionaires from the company on this year’s list (all of them newcomers). Vivas owns approximately 2% of AppLovin and has served on its board since 2018.

Marc Lore

Net worth: $4 billion | Age: 54 | Source of wealth: Ecommerce

The serial entrepreneur behind early internet companies like Diapers.com sold his e-commerce startup Jet.com to Walmart for $3.3 billion in 2016. Lore’s latest venture is Wonder, a food tech startup that bills itself as a “new kind of food hall,” which private investors valued at more than $7 billion in May. A month later, Lore and baseball legend Alex Rodriguez became majority owners of the NBA’s Minnesota Timberwolves, concluding a multi-stage deal signed in 2021 that locked in the purchase price at nearly $1.5 billion. Forbes estimates that the team is now worth around double that.

Brian Venturo

Net worth: $4.2 billion | Age: 40 | Source of wealth: Cloud computing

Venturo cofounded CoreWeave with fellow newcomer Michael Intrator in 2017 and took it public in March. He owns around 7% of the cloud computing company, which signed two deals worth nearly $16 billion combined with OpenAI to deliver AI infrastructure during the first half of this year.

Travis Boersma

Net worth: $4.3 billion | Age: 54 | Source of wealth: Coffee

Shares of Dutch Bros Coffee are piping hot, with thirsty customers and investors helping push the stock up more than 100% since last year’s list. Boersma and his late brother began selling coffee from a push cart in 1992. Now he’s executive chairman of the chain, which has more than 1,000 locations across 19 states.

Andrew Karam

Net worth: $4.7 billion | Age: 43 | Source of wealth: Marketing software, mobile games

The AppLovin cofounder reported owning just over 4% of the company as of last September, when he dropped below the SEC’s ownership disclosure threshold, after unloading nearly a third of his pre-IPO stake for an estimated $500 million (pre-tax). If he’d held onto all of the shares he owned before AppLovin went public in 2021, he’d be worth closer to $11.5 billion today.

David Dean Halbert

Net worth: $4.9 billion | Age: 69 | Source of wealth: Biotech

Halbert owns approximately 44% of Caris Life Sciences, a cancer diagnostics company he acquired in 2008, that uses gene sequencing, AI and machine learning to detect and monitor disease. The company went public in June at a $5.9 billion valuation and shares are up some 30% since.

Stephen Cohen

Net worth: $5.4 billion | Age: 42 | Source of wealth: Software

Cohen cofounded Palantir in 2003 alongside fellow Forbes 400 members Peter Thiel and Alexander Karp, who still serves as the company’s CEO. It’s now a $360 billion (market capitalization) data mining giant and Cohen, who sits on the board, has been cashing in on its skyrocketing stock, which is up 400% over the past year. He’s sold more than $500 million worth of stock (pretax) since November.

Vlad Tenev

Net worth: $5.8 billion | Age: 38 | Source of wealth: Stock trading app

Tenev’s fortune has soared fivefold since the 2024 Forbes 400 as investors have taken notice of Robinhood’s exploding crypto business. The stock trading app’s revenue from crypto jumped from $135 million in 2023 to $626 million in 2024, helping push the company’s shares up some 415% in the last year and catapulting Robinhood into the ranks of the world’s 250 most valuable companies.

Michael Intrator

Net worth: $6.7 billion | Age: 56 | Source of wealth: Cloud computing

Coreweave’s March IPO minted four new billionaires, including Intrator, his two cofounders and an early investor. Only two of them are rich enough to make The Forbes 400. Intrator has been the biggest winner by far, worth $2.5 billion more than his fellow newcomer Brian Venturo. CoreWeave’s CEO, Intrator owns approximately 11% of the cloud computing company.

Michael Dorrell

Net worth: $8.5 billion | Age: 52 | Source of wealth: Investing

The Australian-American investor is chairman and CEO of infrastructure investing firm Stonepeak, which he cofounded in 2011 and has grown to manage more than $76 billion in assets. He sold a $2 billion stake to investment firm Blue Owl Capital in 2023, valuing Stonepeak at roughly $15 billion.

Robert Pender

Net worth: $12.8 billion | Age: 72 | Source of wealth: Oil & gas

Michael Sabel

Net worth: $12.8 billion | Age: 58 | Source of wealth: Oil & gas

In January, the duo took liquified natural gas exporter Venture Global public at a nearly $60 billion valuation in one of the largest energy IPOs in U.S. history. The company’s stock has lost nearly half of its value since, due in part to volatile LNG prices and a heavy debt load, but cofounders Pender and Sabel, who own a roughly 84% stake combined, are still comfortably rich enough to make the 400. They serve as Venture Global’s executive co-chairmen and worked together as co-CEOs until 2020, when Pender retired from that role and Sabel became sole chief executive.

Adam Foroughi

Net worth: $17.4 billion | Age: 45 | Source of wealth: Marketing software, mobile games

Unlike his cofounder Karam, AppLovin’s CEO has held onto almost all of his stock since the company went public in 2021, leaving him with a nearly 11% stake in the firm. Thanks to AppLovin’s soaring stock price, Foroughi’s fortune has grown by more than $14 billion over the past year.

Edwin Chen

Net worth: $18 billion | Age: 37 | Source of wealth: Artificial intelligence

Chen founded data labeling company Surge AI in 2020 with a few million dollars and, as its CEO, grew annual revenue to over $1 billion in just five years, claiming to do so without raising money from outside investors. Forbes estimates that the company is now worth $24 billion, making Chen’s estimated 75% ownership stake worth $18 billion. Surge AI improves the quality of data being used to train AI models for some of the most prominent players in the space, including Google, OpenAI and Anthropic.

More from Forbes