Key Global FinTech investment in 2024:

Global FinTech deal activity halved in 2024India joined top three for global deal activity with 4% of the overall dealsSvatantra, a technology driven microfinance company, secured one of the largest FinTech funding rounds in India in 2024 with a $230m private equity investment deal

Global FinTech deal activity halved in 2024

The global FinTech market faced a substantial downturn in 2024, with both funding and deal activity declining sharply compared to the previous year.

Total funding fell to $89.66bn, marking a 45% drop from the $164.45bn raised in 2023.

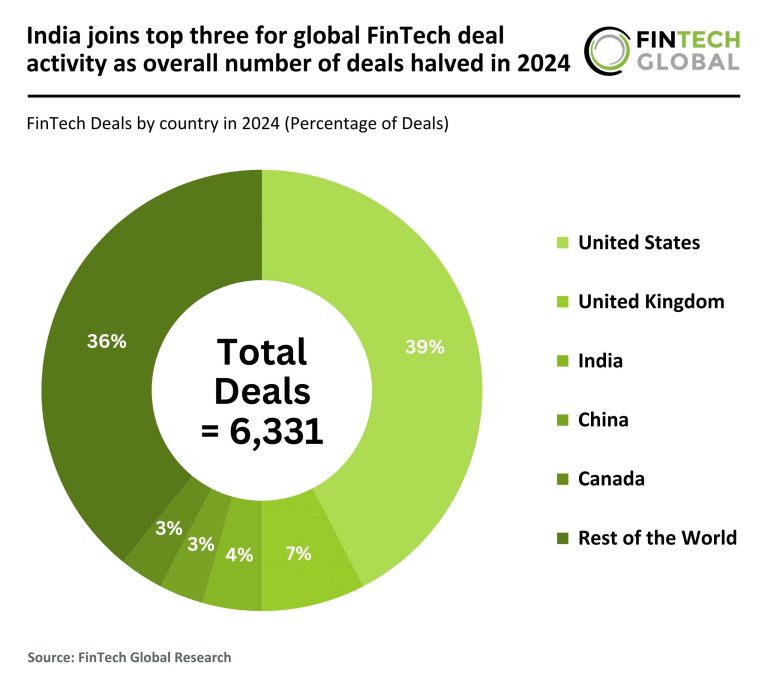

Deal volume also contracted significantly, with 6,331 deals recorded in 2024, a steep 57% decline from the 14,604 deals completed the previous year.

This downturn underscores the impact of macroeconomic pressures, including rising interest rates and investor caution, which have constrained capital flows into the sector.

India joined top three for global deal activity with 4% of the overall deals

The United States remained the most active market for global FinTech deal activity, accounting for 2,492 deals (39% share) in 2024, though this represented a 60% decline from the 6,201 deals recorded in 2023.

The United Kingdom followed with 466 deals (7% share), a steep drop from the 1,236 deals completed the previous year.

India moved into the third spot with 274 deals (4% share), replacing China, which was among the top three in 2023 with 781 deals.

This shift highlights India’s growing presence in the global FinTech landscape, even as overall deal-making activity has slowed considerably across major markets.

Svatantra, a technology driven microfinance company, secured one of the largest FinTech funding rounds in India in 2024 with a $230m private equity investment deal

The company provides affordable financial and non-financial solutions to women entrepreneurs, it has emerged as one of the most differentiated process and technology-driven microfinance entities in India.

Svatantra, along with its wholly owned subsidiary, Chaitanya, has a team of more than 17,000 employees and serves over 4.2m customers across 20+ states.

Svatantra offers microcredit at affordable rates and has been a first mover and shaker of the industry by being the first MFI with 100% cashless disbursements since inception.

It is also the first to roll out an extensive customer-facing app that is conducive to client social behaviours.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.