Key European RegTech investment stats in Q1 2025:

European RegTech funding fell by a fifth QoQ in Q1 2025Average deal value decreased to $4.6m as deal activity stabilised due to investors moving to a conservative investment approachThreatMark, a RegTech innovator specialising in fraud prevention for financial institutions, secured one of the quarter’s largest European RegTech deals with a $23m funding round

European RegTech funding fell by a fifth QoQ in Q1 2025

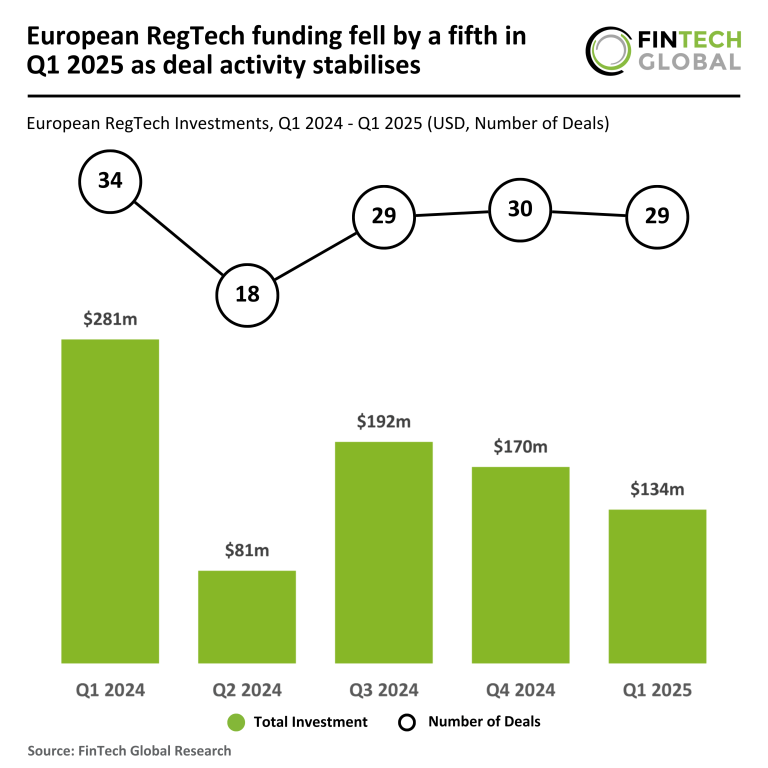

In Q1 2025, the European RegTech sector continued to face headwinds, with both deal activity and funding experiencing further declines year-over-year.

Only 29 deals were recorded in Q1 2025, marking a 15% decrease from the 34 deals completed in Q1 2024.

Funding fell even more sharply, with European RegTech firms raising just $134m in Q1 2025—a 52% drop from the $281m raised in Q1 2024.

This significant reduction in capital inflow underlines a cautious investment climate across the region, with stakeholders likely responding to persistent economic uncertainty and regulatory shifts.

When compared to Q4 2024, both deal activity and funding continued their downward trajectory.

The number of deals dropped from 30 to 29, a 3% decline quarter-on-quarter, while funding decreased by 21%, falling from $170m in Q4 2024 to $134m in Q1 2025.

Average deal value decreased to $4.6m as deal activity stabilised due to investors moving to a conservative investment approach

The average deal size in Q1 2025 stood at $4.6m—down from $8.3m in Q1 2024 and slightly lower than the $5.7m average in Q4 2024.

This ongoing contraction in deal value reflects a conservative investment approach, with investors prioritising smaller, less capital-intensive deals as the European RegTech market navigates a slower growth environment and heightened scrutiny.

ThreatMark, a RegTech innovator specialising in fraud prevention for financial institutions, secured one of the quarter’s largest European RegTech deals with a $23m funding round

The round was led by Octopus Ventures, Riverside Acceleration Capital, and Springtide Ventures.

The company’s AI-powered Behavioural Intelligence Platform integrates behavioural biometrics, transactional monitoring, and threat detection to provide real-time fraud prevention without disrupting the user experience.

In a financial landscape where global fraud losses reached $486bn in 2023, ThreatMark’s technology addresses a critical need for more adaptive and intelligent fraud defences.

The new capital will enable the firm to scale its advanced solutions across a broader spectrum of institutions and accelerate product innovation, cementing its role as a key player in the RegTech ecosystem.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.