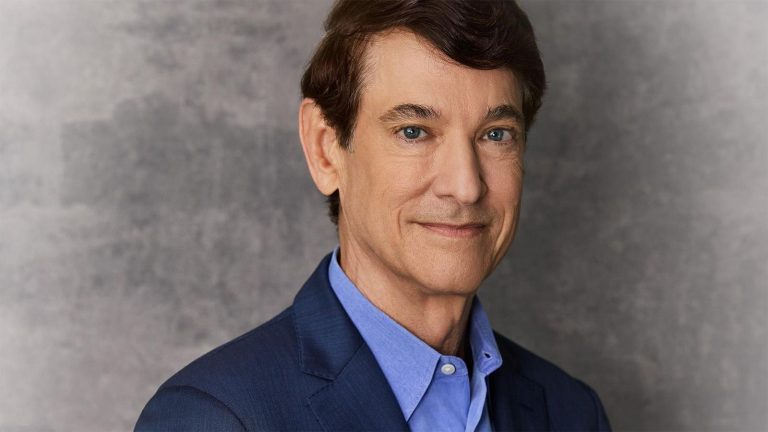

Venture capitalist Jim Breyer made his first billion from Facebook two decades ago when it was far from a sure thing. Now, with his two adult sons as partners and a family tragedy behind him, he’s got another big win and ambitions to reinvent healthcare.

It’s the middle of August, and venture capitalist Jim Breyer has travelled from his home in Austin, Texas to his gated compound in Pebble Beach, California to catch some of the Monterey Car Week events, including the “world’s most prestigious car show,” Concours d’Elegance. Breyer enjoys admiring the sleek cars, but isn’t an avid collector–a newish BMW and a Land Rover sit in his driveway. He’s here to play some golf and catch up with friends.

Chatting up folks and listening to people talk is probably Breyer’s super power. He would rather talk about ideas and investments, and yes, college football, than just about anything else. The man who became a billionaire in 2011 and cemented his superstar reputation–thanks to a very early bet on Facebook–smashed another early bet out of the park, this time with the June initial public offering of Circle Internet Group, the creator of a stablecoin called USDC. Circle’s market cap quickly zoomed to $55 billion as crypto enthusiasts scooped up shares. Breyer, the second largest individual shareholder after the company’s CEO and cofounder Jeremy Allaire, immediately more than doubled his fortune to $5.7 billion.

“I want founders to have skin in the game. I love it when investors have significant skin in the game,” he explains.

Since then, the frenzy around Circle has lost some of its initial fervor. Shares of Circle, which primarily pulls in revenue from investing in U.S. Treasury bills to back its stablecoin, have fallen nearly 50% through September 29 from their late June (perhaps over-exuberant) peak. Yet Circle still sports a lofty $33 billion market capitalization–more than 12 times this year’s forecast $2.5 billion in revenue. Breyer, who cashed out nearly $100 million in mid-August, still has an 8% stake worth more than $1.7 billion. Combined with his other assets, he’s got an estimated $3.8 billion fortune–double what it was earlier this year, and enough to put him back on The Forbes 400 list of richest Americans for the first time since 2021.

The payoff for his latest hit was a dozen years in the making. Breyer first invested in Circle in 2013, four years after Bitcoin was introduced to the world. Back then, Circle was a place to hold and store cryptocurrencies. Stablecoins hadn’t yet entered the lexicon. But Breyer had backed Allaire at his previous startup, online video firm Brightcove. The two men met at Harvard Yard, went on a long walk and, yes, chatted. Before they parted ways, the pair shook hands on the deal, says Breyer, who wanted to secure an early spot at the table. “I had a conviction based on all the due diligence that I was doing that crypto infrastructure and the stack would provide phenomenal opportunities,” recalls Breyer, who paid 27 cents a share back then.

Breyer, who topped Forbes’ Midas list of best venture capital investors in 2011, 2012 and 2013, has stacked up plenty of notable wins. Circle, he says, is one of four investments that’s made him at least a 100x return. The other three are Facebook, which he and his Silicon Valley VC firm Accel Partners backed at an initial four cents a share (it recently traded at $743 a share); and two late 1990s networking hardware companies–Foundry Networks and Redback Networks–both of which went public in 1999 before the dot.com crash and were later acquired.

Fifteen others, he says, have returned more than 20 times the original investment, including cash dividends. Among them: Spotify, which he backed in 2011 when it was valued at $900 million; he still holds shares in the now $149 billion (market value) company. Another winner was his multi-million dollar investment in the NBA’s Boston Celtics alongside his friend since grade school, Wyc Grousebeck, who led the $360 million purchase in 2002. Breyer sold his stake this year, when a group led by Silicon Valley financier Bill Chisholm bought 51% of the team in a deal valuing the franchise at $6.1 billion.

Breyer’s ability to prioritize the people as much as the products–from his grade school friend to a hoodie-clad college dropout to a former Israeli soldier to a wanna-be photographer–led to other wins: Marvel (which sold to Disney for $4 billion in 2009), Etsy (which went public in 2015) and Legendary Pictures (acquired by China’s Wanda Group for $3.5 billion in 2016). Along the way, Breyer has also served on the boards of Walmart, Dell, News Corp. and Harvard. He now sits on Blackstone’s board. “I’ve seen his openness,” says Blackstone President Jon Gray, “I do think that’s a very unique attribute he has.”

Breyer’s Instagram posts are a testament to that openness and wide-ranging interests. He’s at the French Open tennis tournament. Or hanging out with former Led Zeppelin guitarist Jimmy Page. Then at the American Film Institute (where he’s a longtime board member) gala celebration of Francis Ford Coppola in Los Angeles, followed soon after by a new Picasso exhibit at the Gagosian Gallery. In August he snapped a shot of actor Matthew McConaughey emceeing the “Band Together Texas” country music fundraiser for flood relief. Then there are the many snaps at UT Longhorn football games around the country. Breyer, who moved from Silicon Valley to Austin five years ago, has indeed gone all Texas. That now means owning more than 20 pairs of cowboy boots and making it to 90% of his adopted team’s football games.

“My children would say, ‘Dad, you’re interested in too many things’,” he laughs, “and they’re right!”

His broad interests began as a young child. Like dozens of others on The Forbes 400, Breyer was the first member of his family born in the U.S. His parents fled Hungary during the 1956 revolution, living in Vienna for a year before his father got a scholarship to Yale. His family arrived in the U.S. with $500 and lived in a funeral home in New Haven initially. His parents later moved to Boston, where both worked at Honeywell. In 1979 Breyer headed off to Stanford University, where he majored in interdisciplinary studies—a mix of computer science and economics—and spent a semester in Florence, Italy his junior year. After college he spent two years at McKinsey and then headed to Harvard for an MBA. After graduation, he took a job at Accel Partners in 1987, then a two-person venture firm run by Citicorp veterans Arthur Patterson and Jim Swartz. Breyer’s aim, he now says, was to become an entrepreneur. “I had a very mistaken idea that by spending a couple years in venture capital, I would meet a lot of entrepreneurs, I would see a lot of business plans, and that would enable me to start my own company,” he says. A few years later, he realized he wouldn’t make a good operating executive. “I’ve always loved investing.”

The bet on Facebook couldn’t have come at a better time for Accel, which had missed out on Google and had lost some big institutional investors such as Harvard and Princeton. Pitched by a young new principal, Kevin Efrusy, the Accel team was sold after a demo by Mark Zuckerberg at a Monday partners meeting in 2005. To seal the deal–and edge out the Washington Post’s Don Graham–Breyer took the Facebook team to dinner and bought them a nice bottle of wine (Zuck, not yet 21, had a Sprite) according to “The Facebook Effect” book by David Kirkpatrick. He won them over, and agreed to invest $1.1 million of his own money alongside Accel’s $11.7 million. Within six years, he was a billionaire.

It was a year after the initial Facebook investment that Breyer, now 64, began carving out a unique path for himself in venture capital. In 2006, he set up a side hustle of sorts called Breyer Capital, where he bet on companies like comics mainstay Marvel and media giant 21st Century Fox. Accel was fine with the arrangement because such firms were outside of its technology and early-stage venture capital focus.

Breyer left Accel in 2014, nearly three decades after joining and a year after betting on Circle, to invest his own money through Breyer Capital.

In 2020 he and his second wife, Angela Chao–CEO of shipping company Foremost Group (and sister of former U.S. Transportation Secretary Elaine Chao)–moved to Austin, at the urging of friends Michael and Susan Dell. That was also the year he brought his adult sons from his first marriage–Daniel, now 30, and Ted, now 28–into Breyer Capital, making each of them partners, putting family members into what in essence has become a very active family office.

The brothers couldn’t be more different. Ted became fascinated with money at a young age, opening a brokerage account with his dad when he was around six, he says. While Ted was an undergrad at Harvard, he started investing in crypto with money he’d saved from birthday gifts and doing odd jobs over the years. Daniel, a history major at Brown who was obsessed with Stephen King as a child, published his first novel, “Smokebirds,” in April. It’s a dark, rollicking read about a deeply dysfunctional billionaire family. In the book, the billionaire’s son is a video-game addicted venture capital investor who got lucky once with a bet on a virtual reality and game company. “It’s a very introspective novel. If I were to have been raised differently, if I were to be the worst versions of myself, the worst thoughts, who would these people be?” muses Daniel, who insists his father is nothing like the billionaire in the book. Says Daniel about working with his dad, brother and brainy founders, “We’re just the luckiest people on the planet.”

But even Jim Breyer has faced tragedy. In February 2024, Breyer’s wife Chao was at the couple’s ranch in Texas for a girls’ weekend with friends from Harvard Business School. Chao got in her car to drive from the guest quarters where her friends were staying back to the main house, and put the car in reverse by mistake, according to a Wall Street Journal account of what happened. She inadvertently drove her Tesla into a pond and drowned.

Breyer has never talked publicly about the accident, but did say his family has been a source of comfort at this difficult time. He is raising his and Chao’s son, now five years old, with help from two nannies.“So much of it is, I persevere for that little five-year-old, ensuring that I’m the best dad possible and the best dad and partner to the rest of the family,” he says.

Adds Daniel, “He just loves us and loves working with us.”

Bringing his sons along for his latest chapter has been reinvigorating and has kept him looking far into the future. A year after moving to Texas and welcoming his sons into the fold, he adopted a new investment focus, exploring ways to marry AI with life sciences and healthcare. “We look at where artificial intelligence and artificial intelligence technologies can and will create profound outcomes,” he explains. In April he brought in a new Breyer Capital partner: Morgan Cheatham, a promising young venture capitalist and close college friend of his son Daniel’s, to help with these efforts. (They met in an entrepreneurship class at Brown where Breyer made an appearance as a guest speaker.) A Forbes Under 30 2023 list alum, Cheatham worked as an investor at VC firm Bessemer Partners for the past eight years while concurrently pursuing a medical degree at Brown University, his undergrad alma mater. He’s still on that path, pursuing a combined residency and fellowship specializing in genetics while on the hunt for new investments for Breyer Capital.

Next gen money men: From left, Breyer Capital partners Daniel Breyer, Morgan Cheatham and Ted Breyer

Cody Pickens for Forbes

One of the most successful bets so far in the AI-meets-healthcare push is OpenEvidence, a ChatGPT-like free app for doctors to consult the latest medical research. Breyer backed cofounder and CEO Daniel Nadler on his first startup, financial analysis company Kensho, which S&P Global acquired for $550 million in 2018. Already 40% of U.S. doctors have signed up for the free app and are using it for 8.5 million consultations a month. In July the company raised $210 million at a $3.5 billion valuation, making 42-year-old Nadler a billionaire.

Nadler has high praise for Breyer. “He is really different from almost any other investor that I’ve dealt with. And I’ve dealt with the best investors,” says Nadler. “He’s much more interested in the founder and why or what makes them an aberrant exceptional. …Most of these highly successful people are pretty strange birds, and he wants to kind of get into that.” Nadler says that Breyer (and the investors at VC firm Sequoia) asked him questions like, “Why do you have a chip on your shoulder? What motivates you? Why are you so competitive? And what is it about you that is going to make you continue to be competitive even after you have some essential basic financial security?”

Once Breyer invested in Nadler’s companies, he made himself useful. “I’ve just dropped him dozens and dozens of one sentence or sometimes three word emails to which he responds in one or two sentences and just cuts to the straight of it. There isn’t the need for the ceremony of it,” says Nadler. “It’s like talking to a friend.”

And that just may be Breyer’s personal magic: his ability to put entrepreneurs at ease long enough to not only to win the deal, but also help them navigate the obstacles.

More from Forbes