Key LATAM FinTech investment stats for 2024:

LATAM FinTech funding reduced by 13% YoYBrazil reinforced its dominance of the LATAM FinTech market as they secured half of top 10 deals in 2024Ualá, an Argentine-based neobank operating across Latin America, secured the largest LATAM FinTech deal of the year with a $300m Series E funding round

LATAM FinTech funding reduced by 13% YoY

In 2024, the Latin American FinTech sector recorded $2.4bn in total funding across 140 deals, reflecting a 13% decline from the $2.7bn raised in 2023 and a 56% drop in the number of transactions from the 320 recorded the previous year.

Compared to 2020, when funding stood at $3.2bn across 458 deals, the sector has contracted by 26% in total funding and 69% in deal volume, indicating a significant slowdown in activity.

Despite fewer deals, the average deal value in 2024 rose to $16.9m, up from $8.5m in 2023 and more than double the $7m recorded in 2020.

This suggests that while early-stage funding has diminished, larger rounds are still taking place, reflecting investors’ preference for established players over riskier startups in an uncertain economic climate.

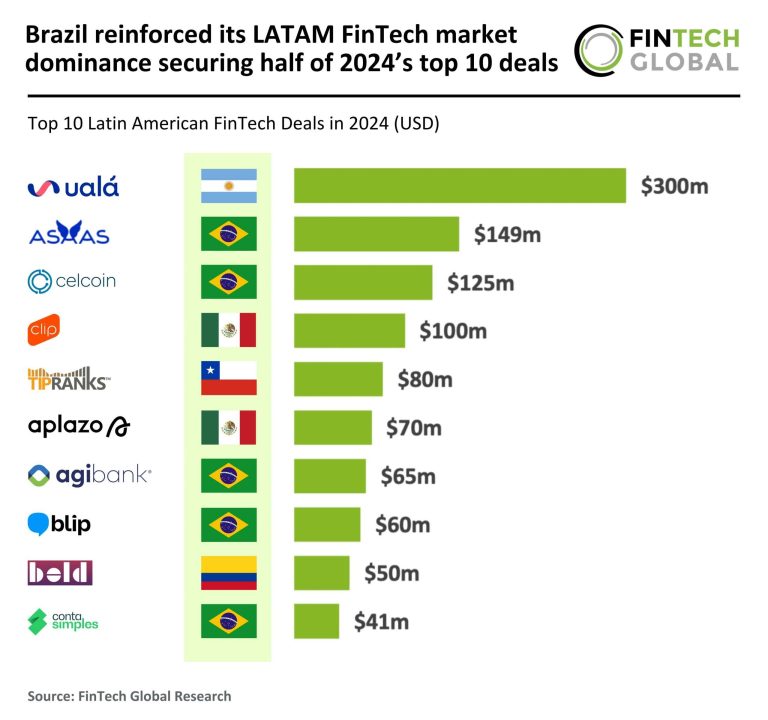

Brazil reinforced its dominance of the LATAM FinTech market as they secured half of top 10 deals in 2024

Brazil maintained its position as the dominant force in Latin American FinTech, securing five of the top 10 deals in both 2023 and 2024.

However, Mexico’s presence in the top 10 declined from three deals in 2023 to two in 2024, while Argentina made an appearance in the rankings after being absent the previous year.

Chile and Colombia remained steady with one top deal each in both periods, indicating continued but selective investor interest in these markets.

The absence of additional Mexican deals and the re-emergence of Argentina may suggest a shift in investment focus, as investors look to diversify beyond the region’s historically strongest markets.

Despite these changes, Brazil continues to lead as the primary hub for FinTech innovation and investment in Latin America.

Ualá, an Argentine-based neobank operating across Latin America, secured the largest LATAM FinTech deal of the year with a $300m Series E funding round

Led by Allianz X, with participation from prominent investors like Stone Ridge Holdings, Tencent, and Goldman Sachs Asset Management, the funding will fuel Ualá’s expansion across Argentina, Mexico, and Colombia.

Leveraging its proprietary AI-driven tools such as UaláScore, the neobank aims to enhance personalised financial offerings, including credit scoring, loans, and investment products, while continuing to drive financial inclusion.

Ualá’s banking licenses and partnerships, including with Allianz X, position it to innovate further in both banking and insurance solutions, advancing its mission to provide accessible and comprehensive financial services to over eight million users across the region.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.