Key Asian InsurTech investment stats in 2024:

Asian InsurTech funding plunged by 71%in 2024Deals over $100m in 2024 reached a 5-year lowbolttech, a global InsurTech company focused on building a technology-enabled ecosystem for insurance, secured the biggest Asian InsurTech deal of the year with over $100m raised in its Series C funding round

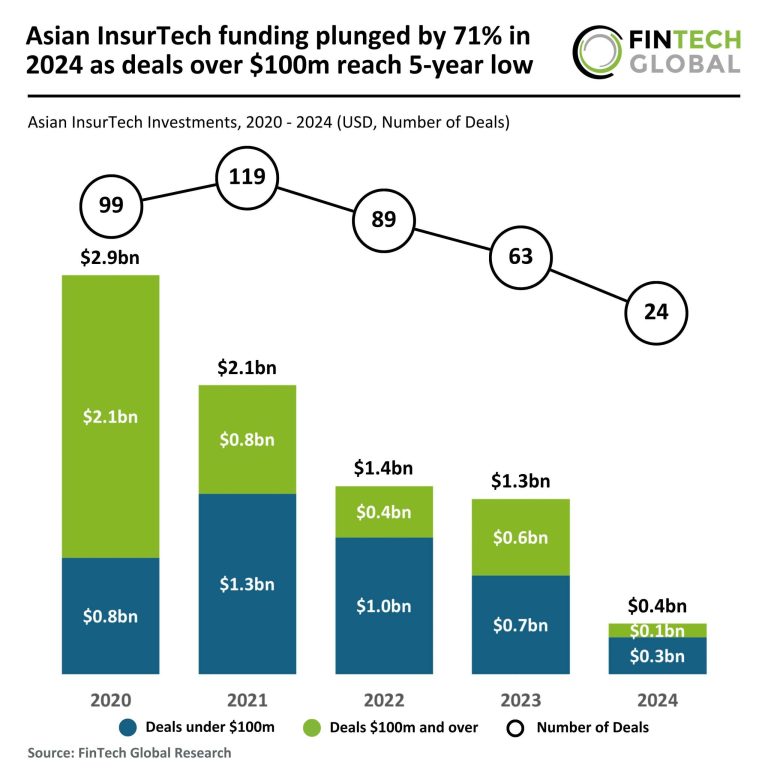

Asian InsurTech funding plunged by 71% in 2024

The Asian InsurTech market saw a significant decline in both deal volume and total funding in 2024.

The year closed with 23 deals, marking a 63% drop from the 63 deals recorded in 2023 and a 77% decline from the 99 funding rounds completed in 2020.

Total funding in 2024 amounted to $369m, representing a sharp 71% decrease from the $1.3bn raised in 2023 and an 87% decline from the $2.9bn secured in 2020.

The average deal size in 2024 stood at $16m, reflecting a 21% drop from $20.3m in 2023 but a 49% increase from $10.6m in 2020.

Deals over $100m in 2024 reached a 5-year low

Funding from deals under $100m reached $269m in 2024, a 63% decrease from the $719m recorded in 2023 and a 68% decline from the $848m seen in 2020.

Meanwhile, high-value deals of $100m or more accounted for just $100m, down 82% from the $559m raised in 2023 and a steep 95% drop from the $2.1bn secured in 2020.

Notably, this is the lowest amount raised by deals of this size in the past five years, highlighting a growing risk-averse sentiment among investors.

The overall contraction in funding signals continued challenges for the sector, as investors reassess opportunities amid evolving market conditions.

bolttech, a global InsurTech company focused on building a technology-enabled ecosystem for insurance, secured the biggest Asian InsurTech deal of the year with over $100m raised in its Series C funding round

Led by Dragon Fund, backed by Liquidity and MUFG, alongside investors including Baillie Gifford and Generali’s Lion River, the investment values bolttech at $2.1bn.

The funding will further enhance bolttech’s platform capabilities, expand its global market presence, and accelerate its mission to make insurance more accessible, affordable, and convenient.

Operating in more than 35 markets across Asia, Europe, North America, and Africa, bolttech’s digital and data-driven solutions connect insurers, distributors, and customers, streamlining the buying and selling of insurance products.

This latest investment reinforces bolttech’s position as a leader in the InsurTech space, following its record-breaking Series A and B rounds.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.