AI in insurance market is expected to grow from $8.13bn in 2024 to $141.44bn by 2034, driven by investments in AI-powered risk assessment and automationAI is transforming underwriting, claims processing, and fraud detection, with productivity having increased and operational costs expected to drop by 40% by 2030AI-driven personalisation remained in high demand, with 80% of consumers preferring tailored insurance services

AI in insurance market is expected to grow from $8.13bn in 2024 to $141.44bn by 2034, driven by investments in AI-powered risk assessment and automation

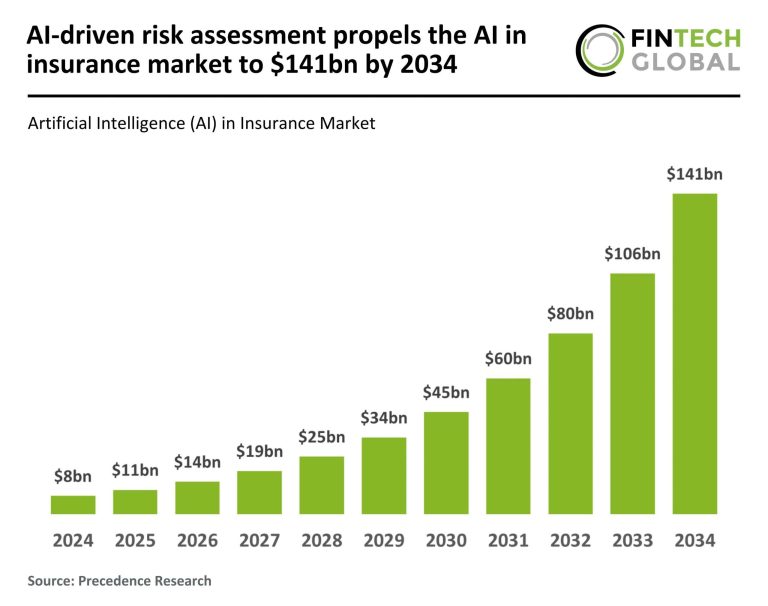

According to the Artificial Intelligence (AI) in Insurance Market report by Precedence Research, the market is set for extraordinary growth, with its valuation expected to increase from $8.13bn in 2024 to $141.44bn by 2034.

This dramatic expansion is being driven by growing investments in AI-driven technologies aimed at improving risk assessment, streamlining operations, and enhancing customer experiences.

AI-powered solutions such as predictive analytics, machine learning, and automated claims processing are transforming the insurance sector by reducing operational costs, increasing efficiency, and enabling more personalised insurance offerings.

As insurers continue to integrate AI into their processes, they are poised to capitalise on the evolving digital landscape and shifting consumer expectations.

AI is transforming underwriting, claims processing, and fraud detection, with productivity having increased and operational costs expected to drop by 40% by 2030

The rapid advancement of AI is reshaping multiple aspects of the insurance industry, from underwriting and claims management to fraud detection and customer engagement.

Traditional underwriting, which once relied on manual assessments and actuarial analysis, is now being revolutionised by AI-powered data analytics that enable faster and more precise risk evaluation.

In claims processing, AI-driven automation is accelerating settlements, minimising fraudulent claims, and improving customer interactions through virtual assistants and AI-powered chatbots.

According to Precedence Research, AI is projected to boost productivity in insurance processes and reduce operational costs by up to 40% by 2030, further cementing its role as a transformative force in the sector.

AI-driven personalisation remained in high demand, with 80% of consumers preferring tailored insurance services

The increasing adoption of AI in insurance is being propelled by rising investments, growing demand for personalised policies, and advancements in cloud computing and machine learning.

Insurers are committing substantial resources to AI technologies to maintain their competitive edge in an increasingly digital marketplace.

However, challenges such as data privacy and security concerns remain significant, given the sensitivity of customer data and the need for strict regulatory compliance.

Despite these hurdles, AI presents immense opportunities for insurers to tailor their offerings through behavioural analytics, allowing customers to pay for coverage based on their specific needs.

Precedence Research highlights that 80% of insurance consumers prefer personalised services, and AI is proving to be a crucial enabler in delivering these customised experiences.

As AI continues to redefine the insurance sector, firms must adopt a comprehensive digital strategy to navigate this fast-evolving landscape effectively.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.