Key German WealthTech investment stats in 2024:

German WealthTech investments dropped by 70% in 2024 YoYAverage deal value dropped to $12.9m as investors grow cautiousQPLIX, a German WealthTech company specialising in wealth management software for family offices and private banks, secured the one of biggest German WealthTech deals of the year with a funding round of $26.5m

German WealthTech investments dropped by 70% in 2024 YoY

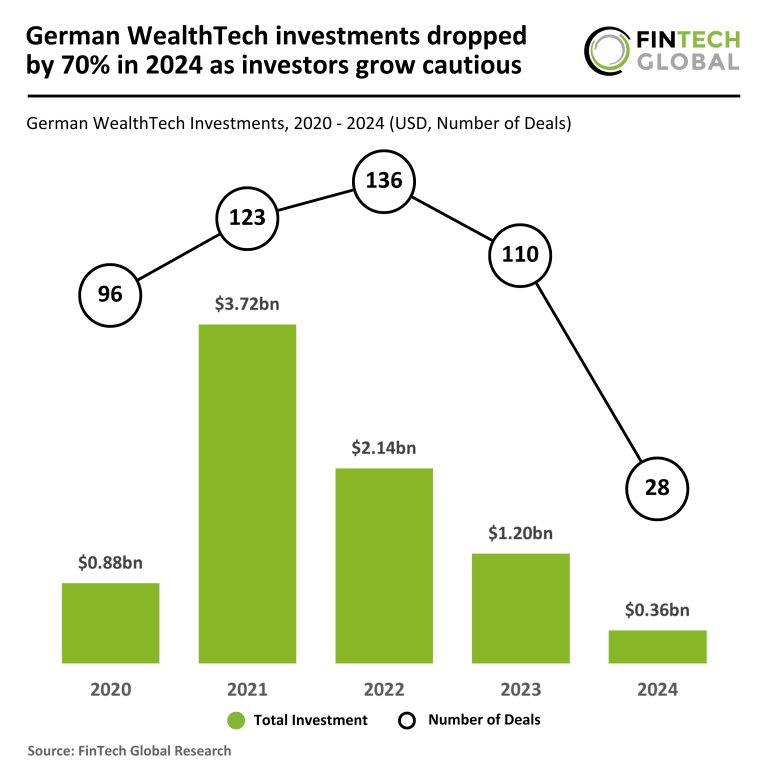

In 2024, the German WealthTech sector experienced a significant decline in both deal activity and total funding compared to the previous year, reflecting a more challenging investment environment.

A total of 28 deals were recorded in 2024, marking an 82% decrease from the 154 deals completed in 2023.

Total funding also saw a sharp contraction, with German WealthTech firms raising $362m in 2024—a 70% drop from the $1,204m raised in 2023.

This represents a substantial pullback in capital commitments, as investors have become increasingly cautious amidst economic uncertainty and shifting regulatory conditions.

Average deal value dropped to $12.9m as investors grow cautious

The average deal value in 2024 was $12.9m, a 10% decrease from the $13.7m average in 2023.

Although deal sizes have remained relatively stable, the steep decline in overall deal volume suggests that investors are focusing on a select few firms, potentially those with more established business models or innovative solutions that align with evolving market demands.

Compared to 2020, when the sector raised $881m across 171 deals, the downturn in 2024 highlights the volatility of the investment landscape in the WealthTech space.

While the sector had seen a surge in funding between 2020 and 2023, the current market correction underscores the increased scrutiny from investors and a preference for more measured capital deployment.

As German WealthTech firms navigate this downturn, securing investment may require a stronger emphasis on profitability, differentiated product offerings, and alignment with long-term industry trends such as digital wealth management, AI-driven financial planning, and regulatory compliance solutions.

QPLIX, a German WealthTech company specialising in wealth management software for family offices and private banks, secured the one of biggest German WealthTech deals of the year with a funding round of $26.5m

The funding was from tech investment firm Partech via its Growth Fund.

This funding, alongside Deutsche Bank’s existing minority stake, will drive QPLIX’s international expansion into key markets such as France, Switzerland, the United Kingdom, the Middle East, and the APAC region.

QPLIX provides a comprehensive digital asset management solution that integrates all asset classes, offering advanced analytics, highly customisable reporting, and an integrated order engine to support the entire portfolio lifecycle.

With more than $300bn in assets managed on its platform, QPLIX continues to strengthen its reputation through agile product development, consulting expertise, and robust IT infrastructure, positioning itself as a key player in the WealthTech space.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.