Key Asian InsurTech investment stats in 2024:

Asian InsurTech deal activity dropped by 64% YoYIndia secured over a third of the Asian InsurTech deals as it cemented its place as the leading InsurTech hub in Asia in 2024Zopper, an Indian InsurTech startup specialising in tailored insurance solutions, secured the biggest Indian InsurTech deal of the year with a $25m Series D funding round

Asian InsurTech deal activity dropped by 64% YoY

The Asian InsurTech market saw a sharp decline in 2024, with both funding and deal activity significantly lower than the previous year.

Total funding dropped to $369m, marking a steep 71% decline from the $1.3bn raised in 2023.

Deal activity also saw a substantial contraction, with only 37 transactions completed in 2024, down 64% from the 102 deals recorded in 2023.

The slowdown reflects broader challenges within the InsurTech sector, including investor caution, regulatory hurdles, and a shift in funding priorities across the region.

India secured over a third of the Asian InsurTech deals as it cemented its place as the leading InsurTech hub in Asia in 2024

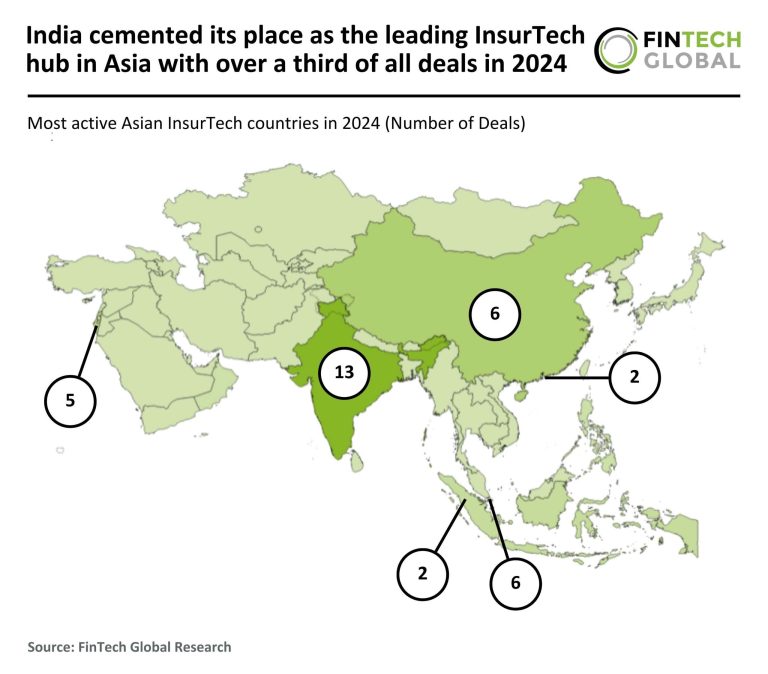

India remained the most active country in the Asian InsurTech market, accounting for 13 deals (35% share) in 2024, down from 25 in 2023.

China and Singapore followed, each with six deals (16% share), compared to 13 deals each in the previous year.

This reshuffling of rankings highlights India’s continued dominance in the sector despite declining deal volume, while China and Singapore have maintained a presence but at significantly reduced activity levels.

The overall contraction underscores the difficulties facing InsurTech startups in securing capital amid challenging market conditions.

Zopper, an Indian InsurTech startup specialising in tailored insurance solutions, secured the biggest Indian InsurTech deal of the year with a $25m Series D funding round

The funding round was led by Elevation Capital and Dharana Capital, with participation from Blume Ventures, the investment will support Zopper in strengthening its digital technology infrastructure and expanding its insurance distribution platform.

The company plans to enhance its data science, data engineering, and AI/ML capabilities while accelerating growth in bancassurance and improving post-sales services for its device and appliance protection offerings.

Founded in 2011, Zopper collaborates with insurance providers to design customised products distributed through its extensive partner network.

Its SaaS-based platform enables seamless integration via APIs, streamlining customer experiences and ensuring end-to-end support.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.