Key Asian RegTech investment stats for 2024:

Asian RegTech deal activity dropped by 35% YoYIndia dominated attracting 21% of all Asian RegTech deals in 2024Equal, a Hyderabad-based RegTech startup specialising in identity verification and financial data-sharing solutions, secured one of the biggest Asian RegTech deals of the year with its $10m Series A funding round

Asian RegTech deal activity dropped by 35% YoY

The Asian RegTech market experienced a significant contraction in 2024, with both funding and deal activity declining sharply compared to the previous year.

Total investment fell to $560m, representing a 57% drop from the $1.3bn raised in 2023.

The number of deals also decreased, with only 113 transactions recorded in 2024, marking a 35% decline from the 175 deals completed the previous year.

This decline reflects ongoing economic uncertainties and investor caution, which have led to reduced capital allocation within the sector.

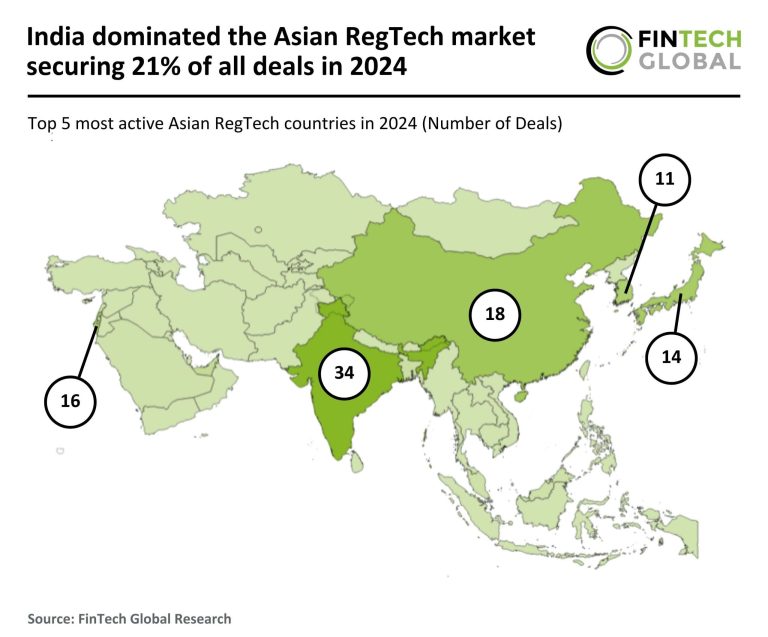

India dominated attracting 21% of all Asian RegTech deals in 2024

India emerged as the most active market for RegTech deals in Asia, accounting for 34 deals (30% share) in 2024, up from 32 deals in 2023.

China, which led the sector in 2023, saw its deal count drop sharply to 18 (16% share) from 45 the previous year.

Israel ranked third with 16 deals (14% share), down from 35 in 2023.

This shift in rankings highlights India’s growing prominence in the Asian RegTech landscape, even as overall market activity has declined significantly.

Equal, a Hyderabad-based RegTech startup specialising in identity verification and financial data-sharing solutions, secured one of the biggest Asian RegTech deals of the year with its $10m Series A funding round

Led by Prosus Ventures, alongside investors including Tomales Bay Capital, Blume Ventures, DST Global Partners, Gruhas VC, Quona VC, and co-founder Keshav Reddy, the investment values Equal at $80m post-money.

Since its founding, Equal has onboarded over 350 customers, including major financial institutions such as State Bank of India, HDFC Bank, ICICI Bank, and large corporates like Reliance Jio, Airtel, Uber, and Zoom.

The company integrates over 50 identity databases and thousands of API providers to streamline KYC, fraud prevention, and regulatory compliance, making it a critical player in India’s fight against rising cyber fraud, which is projected to cost the economy over $14bn annually.

The funding will enable Equal to expand its product suite, scale operations, and build strategic partnerships, further strengthening its position in the competitive FinTech landscape.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.