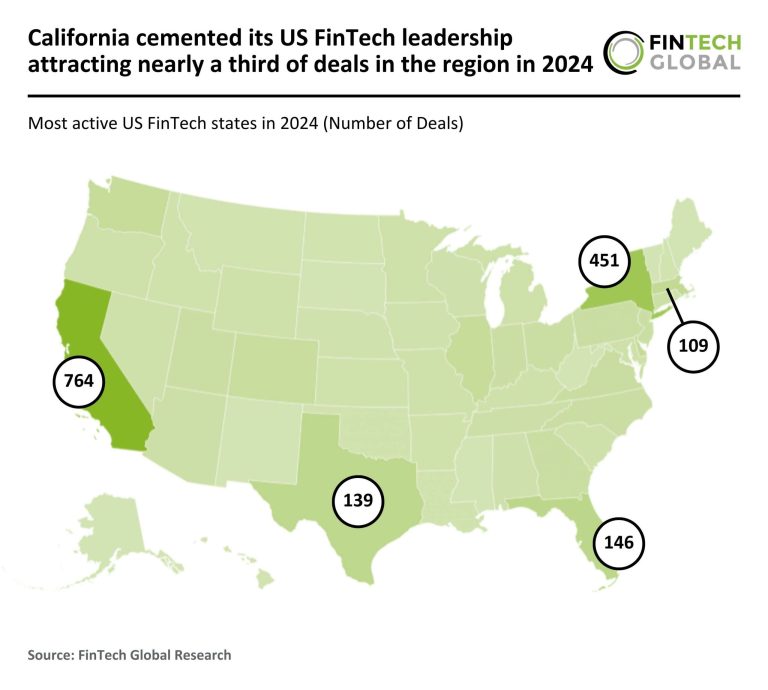

California cemented its US FinTech leadership attracting nearly a third deals in the region in 2024

Key US FinTech investment in 2024:

US FinTech deal activity dropped by 63% YoY in 2024Californian companies secured 31% of the deals in the region as the state solidified its position as the leading US FinTech hubCyera, a leader in the data security space raised one of the largest US FinTech deals during the year with a Series C funding round of $300m

US FinTech deal activity dropped by 63% YoY in 2024

The US FinTech market experienced a sharp downturn in both funding and deal activity in 2024, reflecting broader investor caution and shifting market dynamics.

Total funding fell to $18.4bn, representing a 47% decline from the $34.6bn raised in 2023.

Deal volume also saw a significant contraction, with 1,506 transactions recorded in 2024, marking a 63% drop from the 4,030 deals completed in the prior year.

This steep decline highlights ongoing challenges in the sector as economic uncertainty and higher interest rates continue to impact investment flows into FinTech companies.

Californian companies secured 31% of the deals in the region as the state solidified its position as the leading US FinTech hub

California remained the dominant state for US FinTech activity, with 764 deals (31% share) in 2024, though this marked a 59% decrease from the 1,864 deals recorded in 2023.

New York followed with 451 deals (18% share), reflecting a 56% decline from the 1,016 deals completed the previous year.

Florida emerged as the third most active state, securing 146 deals (6% share) and replacing Texas, which held the third spot in 2023 with 385 deals.

This shift in rankings underscores Florida’s growing presence in the FinTech landscape, even as overall deal activity across the sector has declined considerably.

Cyera, a leader in the data security space raised one of the largest US FinTech deals during the year with a Series C funding round of $300m

The funding round was led by Coatue and joined by Spark Capital, Georgian, and AT&T Ventures, along with existing investors Sequoia, Accel, Redpoint, and Cyberstarts, this investment values the company at $1.4bn.

Founded in 2021 by Yotam Segev and Tamar Bar-Ilan, Cyera has now raised a total of $460m.

Its pioneering, agentless data security platform uses AI and machine learning to discover, classify, assess, and protect data across clouds, SaaS, and on-prem environments, positioning Cyera as a key player in safeguarding enterprises’ most critical asset—data.

The company’s platform is built on advanced AI, machine learning, and cloud computing technologies, which power its data classification engine.

This allows Cyera to quickly and accurately analyse vast amounts of data, helping organisations understand where their data is, who has access to it, and its importance to the business.

This is crucial for preventing data breaches, managing compliance, and improving security postures.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.