Key Indian RegTech investment stats in 2024:

Indian RegTech funding fell by 43% in 2024 YoYAverage deal value dropped to $6m as investors prioritised smaller dealsMumbai-based IDfy, a leader in fraud prevention and trust establishment, secured one of the biggest Indian RegTech deals with a $27m funding round

Indian RegTech funding fell by 43% in 2024 YoY

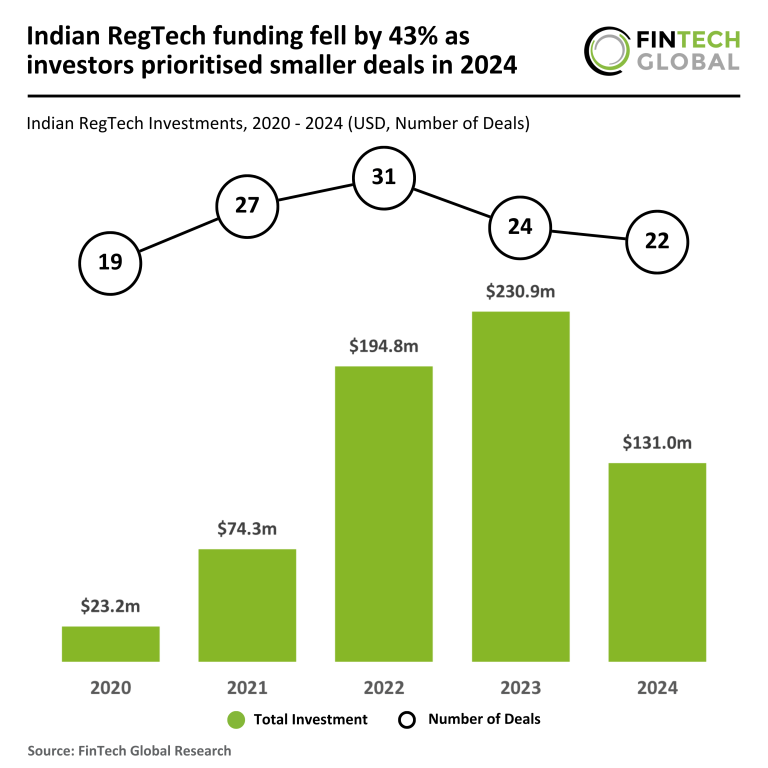

In 2024, the Indian RegTech sector experienced a decline in both deal activity and total funding compared to the previous year, reflecting a cautious investment landscape.

A total of 22 deals were recorded in 2024, representing an 8% decrease from the 24 deals completed in 2023.

While the drop in deal volume was relatively moderate, the reduction in overall funding suggests that investors are becoming more selective in capital allocation.

Total funding in 2024 reached $131m, marking a sharp 43% decline from the $231m raised in 2023.

Despite this setback, investment levels remain significantly higher than in 2020, when RegTech firms in India raised just $23m across 19 deals.

The YoY drop highlights the increasing challenges faced by RegTech firms in securing large-scale investments, possibly due to economic uncertainties and evolving regulatory requirements.

Average deal value dropped to $6m as investors prioritised smaller deals

The average deal value in 2024 was $6m, a 39% decline from the $9.6m average in 2023, yet still significantly higher than the $1.2m average in 2020.

This shift towards smaller deal sizes suggests that investors are proceeding with increased caution, prioritising selective funding rounds over larger-scale investments.

The trend may indicate a focus on well-established players rather than early-stage startups, as firms with proven regulatory solutions continue to attract more attention.

As the Indian RegTech market evolves, securing investment will require firms to demonstrate strong compliance capabilities, scalable business models, and resilience to regulatory changes.

The sector’s ability to adapt to these dynamics will be crucial in maintaining investor confidence and fostering long-term growth.

Mumbai-based IDfy, a leader in fraud prevention and trust establishment, secured one of the biggest Indian RegTech deals with a $27m funding round

The funding round was backed by Elev8, KB Investment, and Tenacity Ventures.

This round of funding supports IDfy’s mission to combat fraud through AI/ML-powered verification solutions, performing over 2 million verifications daily.

Founded in 2011, IDfy serves over 1,500 clients across sectors like BFSI, e-commerce, and FMCG, with a client list that includes major names like HDFC Bank, Zomato, and American Express.

The funds will further enhance IDfy’s expansion and product development, solidifying its presence across India, Southeast Asia, and West Asia.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.