Key Global RegTech investment stats in Q1 2025:

Global RegTech deal activity dropped by 18% YoYUS cemented its place as the leader in the RegTech market with 44% of all dealsCybereason, a leading global cybersecurity company known for its advanced endpoint detection and response (EDR) solutions and expert consulting services, secured one of the largest RegTech deals in Q1 with a $120m funding round

Global RegTech deal activity dropped by 18% YoY

In Q1 2025, the global RegTech industry saw a mixed performance, with a decline in deal activity but an increase in funding.

The sector recorded 173 deals, reflecting a 19% decrease from the 214 deals completed in Q1 2024. However, funding rose to $2.3bn in Q1 2025, marking an 18% increase from the $1.9bn raised in the same period last year.

This rise in capital, despite fewer deals, suggests a shift toward larger funding rounds and growing investor confidence in select high-potential RegTech players.

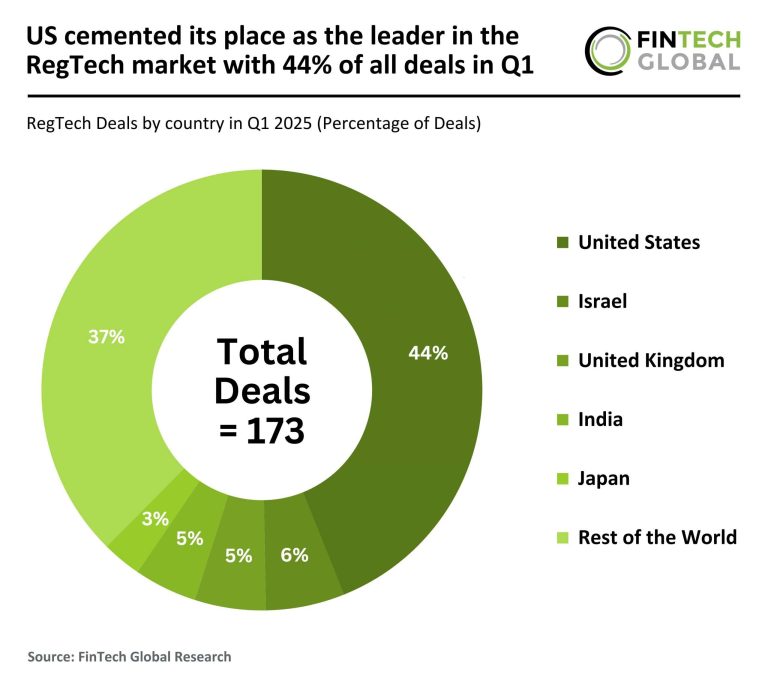

US cemented its place as the leader in the RegTech market with 44% of all deals

The United States remained the dominant market for RegTech investment, completing 76 deals (44% share) in Q1 2025, though this marks a 28% drop from the 105 deals it secured in Q1 2024.

Israel secured 10 deals (6% share), moving into the top three and replacing China, which had recorded 12 deals in Q1 2024.

The United Kingdom ranked third in Q1 2025 with nine deals (5% share), down from 17 deals the previous year.

Despite the overall decline in deal activity, these key countries continue to play a central role in shaping the global RegTech landscape.

Cybereason, a leading global cybersecurity company known for its advanced endpoint detection and response (EDR) solutions and expert consulting services, secured one of the largest RegTech deals of the quarter with a $120m funding round

The investment was led by SoftBank Corp., SoftBank Vision Fund 2, and Liberty Strategic Capital.

The funding underscores strong investor confidence in Cybereason’s capabilities to address increasingly complex cyber threats and solidifies its position as a trusted security partner for enterprises worldwide.

With clients in over 40 countries and a growing strategic partnership with Trustwave, the company is doubling down on its mission to support organisations through every stage of the incident lifecycle.

The capital injection will fuel Cybereason’s global expansion, strengthen its EDR and consulting offerings, and accelerate the adoption of its cutting-edge threat protection platform across highly regulated industries, reinforcing its prominence in the rapidly evolving RegTech space.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.