74% of insurers are prioritising digital transformation and tech adoption in 2025

43 leading insurance C-level executives from across more than 10 countries in Europe, Asia-Pacific, and the Americas were surveyed74% of respondents said digital transformation and technology adoption is their top priority for 2025Long-term goals like ESG and culture shifts ranked lowest on the agenda

43 leading insurance C-level executives from across more than 10 countries in Europe, Asia-Pacific, and the Americas were surveyed

NTT Data’s InsurTech Global Outlook 2025 offered insights from 43 leading insurance C-level executives from across more than 10 countries in Europe, Asia-Pacific, and the Americas.

The survey covered a broad spectrum of lines, including Property & Casualty (26%), Life & Annuities (24%), Health (19%), Specialty (17%), and emerging areas like embedded insurance (10%) and reinsurance (4%).

These interviews captured the perspectives of top executives across global and local markets, providing an up-to-date snapshot of how insurers are reacting to the evolving InsurTech ecosystem.

74% of respondents’ top priority for 2025 is digital transformation and technology adoption

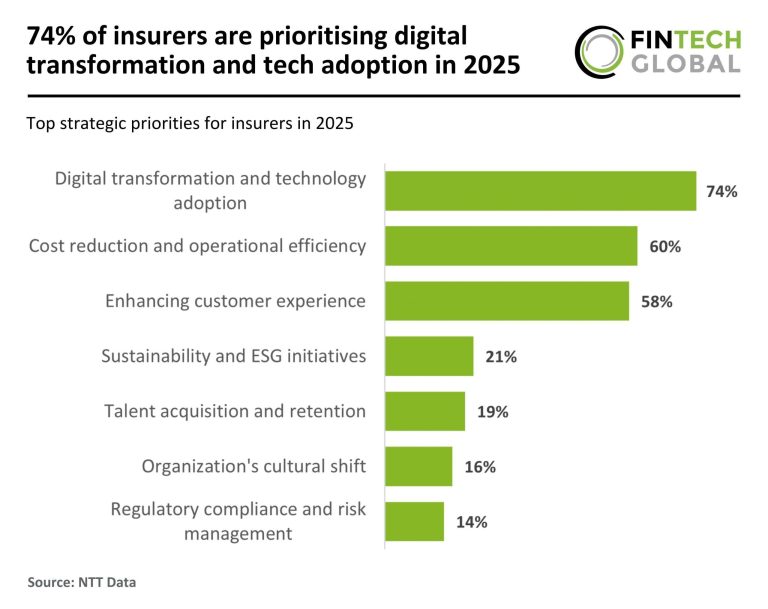

When asked to identify their top strategic priorities for the year ahead, 74% of respondents cited digital transformation and technology adoption, placing it far ahead of other concerns.

Enhancing customer experience (58%) and improving operational efficiency (60%) followed as key focus areas.

The data reflects the urgent need for insurers to modernise their infrastructure in the face of AI, IoT, and cloud-based innovation, while still competing on the quality of customer interactions and overall profitability in a volatile market.

Long-term goals like ESG and culture shifts ranked lowest on the agenda

While digital upgrades and efficiency gains dominated the agenda, only 21% of respondents prioritised sustainability and ESG initiatives.

Even fewer highlighted talent acquisition and retention (19%), cultural transformation (16%), or regulatory compliance and risk management (14%).

This prioritisation pattern indicates a current emphasis on short-term performance over long-term resilience, as insurers continue to navigate economic pressure and shifting consumer demands in the digital age.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.